Gross Income: An individual's total personal income BEFORE taking taxes or deductions into account.

Net Income: An individual's total personal income AFTER taking taxes or deductions into account.

Disposable Income: An individual's total personal income AFTER taking taxes or deductions into account AND paying all BILLS and UTILITIES. (Money that is left over for WANTS)

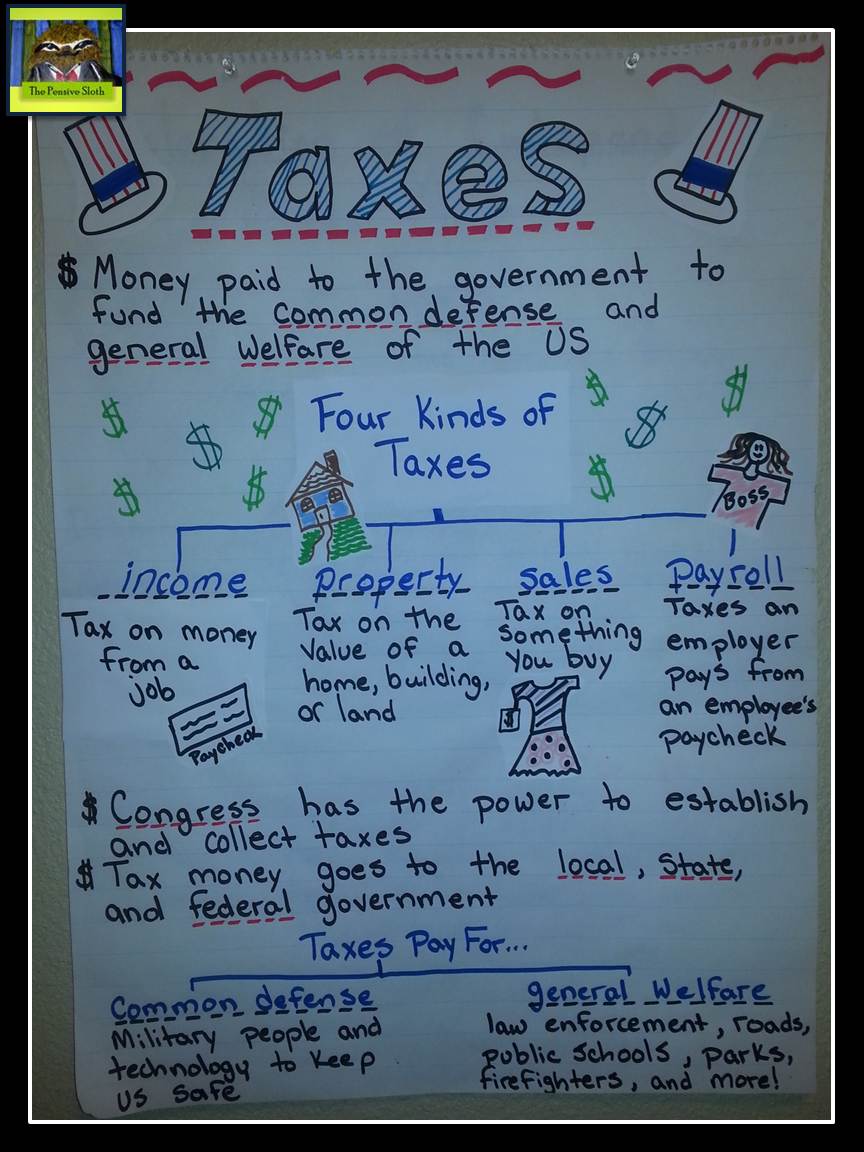

Taxes

•Taxes are money citizens pay to support the government (schools, libraries, etc) •Sales tax is paid when you buy things

• Property tax is paid when you own property, such as a home or land

•Income tax is paid when you have a job (income)

•Payroll Tax is a tax that your employer takes directly from your paycheck before you receive it.

DIFFERENT TYPES OF PAYMENT!

No comments:

Post a Comment